Year 2020

Year 2018

GOPAY – 3 Smart Ways To Save Money

3 Smart Ways To Save Money

Money is hard to earn and even harder to keep especially in today’s economy. Eating less and cutting down insurance is no way to live, nor is taking personal loans a smart option with bank interest rates on the rise.

There are smarter ways to save money that do not involve starving or getting into debt.

Here are 3 of them for your benefit.

#1 Prep a Grocery Shopping List

You know how you have the tendency to go grocery shopping because you happened to be nearby and thought you just needed milk? Then you end up buying a bunch of things you didn’t need but seemed like really good deals that your inner aunty could not resist but to buy them?

That impulse buying habit is exactly what makes you spend more than you think you have. Things like confectioneries and comfort foods are both expensive and not very good for you, so you lose on two fronts by giving in to impulse buying.

Instead, prepare a grocery list of things you need to get for the week, and some of the comfort foods you want. Start by planning what you intend to cook across the week, and list down all the ingredients you need. Then check around the house if you need to replenish any household items running low. Stick. To. The. List. Resist the urge to buy more than you have listed down.

It’s simple, but you’d realise how much money you were wasting on things you didn’t need.

#2 Commitments + Savings First

For our younger readers, commitments refer to the fixed expenses you incur from loans you’ve taken like on your car, house, student loans, etc. Most people consider their commitments and monthly living expenses first, then save whatever is left at the end of the month.

Nothing wrong with that approach, but you might find that it’s hard to save anything some months because expenses just seem to keep piling up somehow. Instead, try adjusting your approach to setting aside the money for your commitments and a fixed savings rate for yourself before planning your expenses.

Let’s say you earn RM5,000 per month and you want to save 15% of your income as a start. Then set aside the RM750 + your commitments first, then budget how you intend to spend the rest on your monthly expenses. This way, you’ll almost always keep to your savings plan unless something unforeseen happens like a visit to the doctor or your car breaks down.

#3 Maximise Cashback & Discounts

Smart shoppers know this trick – only buy the things you want on sale days if possible to save money while still having a lifestyle beyond just living paycheck to paycheck. It pays to do some research on brand sale days or hunt for coupons and discount vouchers on e-commerce platforms for the ultimate stack of savings on the same purchases you would otherwise make for way more at a retail store.

But for things like bills and parking – there are no discounts (unfortunate, we know). BUT you could earn cashback on your monthly bills and even some loan repayments when you pay using the GOPAY app. You already have to pay for those bills every month – so why not earn the cashback every month to use for your next bill cycle? It literally costs you nothing.

Conclusion

The best ways to save are the ways that don’t require you to make drastic changes to your financial and physical health. Taking on debt and eating less healthy food will have a long-term negative impact on your life if you’re not careful.

Opt for the small changes and habits you can make that allow you to save money consistently. These habits will help you become smarter with your savings after some practice.

Keep saving and earn as you pay with GOPAY!

If you have any complications completing your e-KYC verification, you may contact us via email at [email protected] or via Whatsapp at +60177353268.

GOPAY – How to Maximize Cashback Rewards on GOPAY?

How to Maximize Cashback Rewards on GOPAY?

Which Malaysian doesn’t like to get a good deal? That’s probably why you’ve landed on this article – because you’re trying to figure out the best strategy to maximize your cashback.

Unlike other e-wallets that try to let you figure it out on your own (hoping you don’t earn too much) – we’ll show you how to maximize your cashback in every way on our app because that’s why you use our app.

Let’s get started!

Method 1: Group-Pay Bills for Family & Friends

Most people would use our app to pay their personal bills like their phone bills, entertainment subscriptions and utility bills. That’s cashback to you … but what if you paid for all your relatives’ or friends’ bills?

You could offer to pay their bills for them all through your account (you can register multiple bills for each category). Just collect the cash for their bills, pay for them via your GOPAY wallet and earn the cashback on their bills and yours!

Some of our housewife users told us they do that and it helps with family finances because they use the cashback to make smart purchases of groceries and entertainment for the family with the cashback, which helps housewives stretch every ringgit they can.

Method 2: Refer, Refer, Refer!

Just in case you didn’t know, you can earn RM2 right into your GOPAY wallet for each successful referral you get.

This means they have:

- Used YOUR link to download the GOPAY App

- Completed their profile verification (e-KYC)

That’s it!

Just 2 simple steps. If you have 5 friends to refer to GOPAY every month, you’ll cover most of your water bill already!

You can find your unique referral link by following these steps:

- Step 1: Tap on “Account” on the bottom right side of your screen

- Step 2: Tap “Refer a friend” under the Quick Links section

- Step 3: You should be able to see your unique referral code there.

Simply tap “Share” to begin sharing your links with your friend and family so they too can join in on earning as they pay with GOPAY!

Method 3: Join Our Social Media Campaigns

Now and then, we post up campaigns for our community because we appreciate all your support (you’re all awesome)!

Where? Our Facebook and Instagram pages!

We’re also currently having a campaign for all Astro users to join. All you need to do is to be the first 100 to register your Astro account under Bill Presentment in GOPAY and voila! You’ll receive RM15 GOPAY credits in your wallet within 5-7 business days.

All you have to do is stay tuned on our social media pages (we would recommend hitting the notifications bell so you’ll never miss a post from us), and look out for all our upcoming exciting campaigns!

Final Thoughts

The best way to maximize cashback is to ensure you register all the bills you can that are eligible for cashback on our app so you don’t miss out on all the cashback you could get for just paying your bills.

Besides paying bills, you could also use GOPAY to:

- Buy gaming credits (also with cashback!)

- P2P transfer to friends & family

- Pay loans (yes, you can also earn cashback)

- Subscribe to Njoi and TVBAnywhere+ (I’m tired of saying this, but this is also with cashback!!)

Want to start earning as you pay? Download the GOPAY App today!

How To Secure Our E-Wallet

How To Secure Our E-Wallet

Wallets these days are anything but old-fashioned. The digital wallets, that is.

The typical expectations are earning reward points, cashback and convenience for users. But the most important one is security.

Security Risks

There are potential loopholes in any financial ecosystem. Let’s look at some common risks before we move on to the security features that address these risks:

Intercepted Data

Just like how credit cards can be skimmed by tapping, this could possibly happen to a mobile phone. This is due to the reliance on wireless networks. Most regulated e-wallets have preventive measures within their infrastructure. For added security, it’s recommended to turn off the NFC function of the phone.

Inconsistent Security

Certain e-wallets do not have two-factor authentication. A critical factor that prevents fraudulent activities. It’s recommended to verify that the e-wallet is registered with Bank Negara Malaysia to ensure compliance with mandatory security standards.

Fraud Risks

Identity verification is key in preventing impersonation. Most e-wallets should have a process for you to verify your IC when you register for an account to ensure your account is indeed used by yourself, and not someone impersonating you using your credit card credentials.

Good E-Wallet Security Practices

Now that you know the risks, here are a few recommended steps to secure our e-wallets:

Enable Two-Factor Authentication (2FA)

This is an extra layer of security to protect our e-wallets beyond a user ID and password. It is usually executed in the form of a unique code sent to you for each payment, combined with your login password or fingerprint registration. This reduces accidental payments and unauthorized transactions.

Practice Good Password Hygiene

Create long and unique passwords. A combination of lowercase (a,b,c), uppercase (A,B,C), numbers (1,2,3) and symbols (@,&,%) makes the password stronger. Do not use the same one that’s already in use. Avoid birth dates or any personal milestones that are easily recognizable.

Verify Your Account

Account verification is known as Electronic Know Your Customer (e-KYC). By verifying our account, we protect our e-wallet from unauthorized transactions. A simple prevention practice but with a profound impact.

Conclusion

Securing our e-wallets are easy. Ensuring protection at all times while providing the convenience of not having to carry multiple credit cards. Reducing the risk of losing them accidentally.

Plus, there are added benefits such as cashback for every transaction made. What’s there not to love?

If you face any complications completing your e-KYC, you may contact us via email at [email protected] or via Whatsapp at +60177353268.

GOPAY – Why is GOPAY the app for you?

Why is GOPAY the app for you?

GOPAY was created based on a vision, to create a one-stop app for all your digital payment needs. With countless dedicated apps filling up our phones, we all yearn for a centralized platform that will fulfil all our needs. At GOPAY, our goal is to ultimately solve that exact issue.

We aren’t just another e-wallet app. Here is what we have to offer.

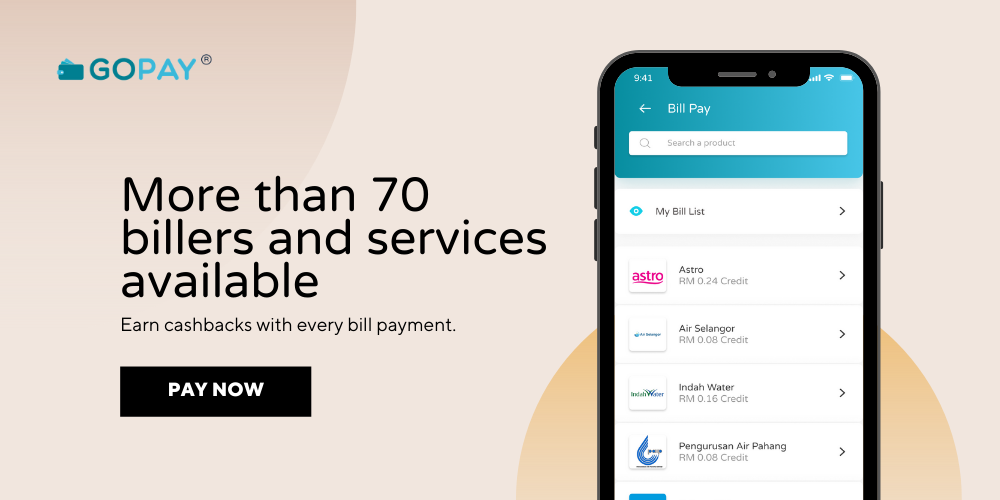

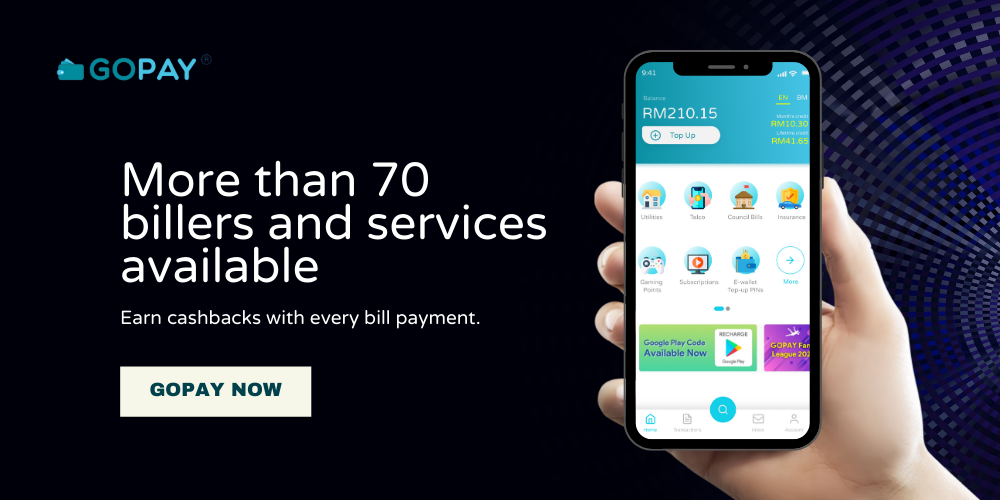

1. Bill Payments

From phone bills to utility bills, we offer a wide range of bill payment services. Our new Bill Presentment feature even allows you to check and receive your bills on the app!

These are some examples of our billing services:

- Telco bills

- Water bills

- Electricity bill

- City council bills

- Entertainment subscriptions

2. Buy Gaming Points

Get that newly released game and your favourite skins in no time! With just a few taps, you can top up your Steam wallet, Playstation wallet, Garena Shells and many more.

3. Loan Payments

Stay ahead of your PTPTN and other loan repayments. Along with your monthly bills, you can make your loan payments within the same app too!

4. Charity Donations

Feeling generous or in the mood to give back to society? You can also make your contributions via GOPAY to your charity of choice.

Apart from that, for every transaction made on our app, GOPAY donates 1sen to charity.

5. Peer-to-peer (P2P) transfers

Bill splitting has never been easier. Simply use our P2P transfer feature to send/receive money for all your billing needs.

EARN as you PAY!

With each transaction made via the GOPAY app, you will be rewarded with cashback. Therefore, the more you pay with GOPAY, the more you earn!

Maximise your cashback by registering multiple billing accounts in your GOPAY app. Pay for your family and friends to reap the rewards!

Receive RM2 with each referral!

Earn RM2 easily with each account activation using your referral code. That’s not all, with these referrals, you will also earn overriding credit down the line. This means that the more transactions they make, the more they earn and the more you earn!

We are constantly introducing new features to our app to make your life easier. Along with these features, win attractive prizes with our campaigns and lucky draws!

Here are some exciting campaigns that we’ve run recently:

- Build your team and join our GOPAY Fantasy Premier League. Win GOPAY credits at the end of each game week with your dream team!

- GOPAY QUIZ! Simply answer our quiz correctly and stand a chance to win RM88.

- GOPAY & WIN with Mastercard! Stand a chance to win a MacBook Air, an electric scooter, a Nintendo Switch and other prizes. Simply use our new Bill Presentment feature and pay your bills to enter the giveaway.

We’re constantly giving out exciting prizes with our latest campaigns and giveaways. Don’t miss out on any of them by following us on our social media for our latest updates. Find us at www.facebook.com/GOPAYnow and www.instagram.com/gopaynow/.

Earn and Pay with us at GOPAY today. With 100,000+ app users to date, we are expanding all over the country as the go-to digital transaction app for all your needs. Be a part of the GOPAYer movement today.

Having an issue with signing up or got a question for us?

Feel free to get in touch with us via email at [email protected] or via Whatsapp at +60177353268

E-Wallet – The future of on-the-go payments

Why are e-wallets the future of on-the-go payments?

We have all heard the age-old saying that cash is king. However, in the past few years, e-wallets have taken the scene by storm, and from the look of things, they might be going for the throne.

Malaysia was introduced to the e-wallet scene back in 2017. Fast forward 6 years later and we now have over 50 different e-wallets used all over the country.

This, however, is only the beginning. The world of fintech is constantly evolving, with new technology being implemented every few months. It is needless to say that fintech and e-wallets, in particular, are the future of our everyday transactions.

Despite that, many are still not convinced. Questions like “How would it benefit me?” and “Is it even safe?” pop up every day. In this article, we will be exploring the benefits of e-wallets and how they may make your everyday transactions much more convenient.

Safety and Security

Security of your finances has always been a menace to society from robberies and snatch thieves to scams and stolen cards. While a wallet can easily be stolen, it isn’t that simple when it comes to e-wallets.

E-wallets nowadays are heavily encrypted and password protected. Even with a stolen phone, it would be tough for these thieves to get through to your e-wallets.

Convenience

You’re standing at the cashier when you realise that you do not have enough cash for the payment. You proceed to whip out your card but that pesky machine is having problems again.

These awkward situations can be avoided with the usage of e-wallets. With a smartphone and internet access, these transactions can be done in a matter of seconds with a few taps. In this modern era, smartphones have become a norm and internet coverage is practically everywhere. E-wallet transactions have also grown tremendously with most stores offering a variety of e-wallet payment options.

Other than store payments, e-wallets also provide other forms of transaction services. Utility bill payments, money transfers, telco payments, parking fees and the list goes on. E-wallets enable users to experience a one-stop-shop experience when using them.

Expenses Tracking

If there is an issue with your verification, a pop-up message will appear informing you about the hiccup. You would be redirected to our customer service Whatsapp.

Please inform our customer service agents regarding the issue and they will personally help you with your verification.

Rewards

All of us love rewards.

From point collection to instant cashback, the possibilities are endless when using e-wallets. These benefits allow users to get the best bang for their buck when using their e-wallets.

Some e-wallets also have partnerships with brands and services to provide their users with special discounts.

Furthermore, giveaways, campaigns and lucky draws are happening all-year round over various e-wallet platforms. If you’re lucky, you might get your hands on some attractive prizes.

How about GOPAY?

At GOPAY, we provide users with a secure all-in-one app for all your payment needs. That’s not all. We offer instant cashback, referral incentives, overriding credit and various campaigns for users to enjoy.

So what are you waiting for? Join the GOPAYer movement today!

Having an issue with the app or got a question for us?

Feel free to get in touch with us via email at [email protected] or via Whatsapp at +60177353268

GOPAY – Verifying your e-KYC

What is e-KYC?

The Electronic Know-Your-Customer (e-KYC) is a practice made mandatory by Bank Negara Malaysia for all financial services. This applies to all financial institutions including e-wallets and any digital payment platforms.

The e-KYC process enables us to digitally verify a consumer’s identity. This verification must be done before allowing a consumer to perform any monetary transactions on the platform.

Many of us would remember opening our first bank account at our local bank. We would fill up some forms and provide our Identification Cards for verification. That verification process is called the KYC (Know-Your-Customer).

In the past few years, fintech has taken the world and country by storm. Thus, the e-KYC was implemented to enable this verification process to be done digitally and remotely.

Why is the e-KYC verification done?

In short, the e-KYC process protects the consumer from scammers and fraud.

In this digital era, rates of cybercrime are on the rise. The e-KYC adds a layer of protection from others trying to impersonate us.

What is required for the verification process?

For the e-KYC process, you would need to provide the following:

-

- Valid Identification Card (IC) or Passport

- Basic personal information (full name as stated on IC/Passport, IC/Passport number, etc)

- A clear selfie

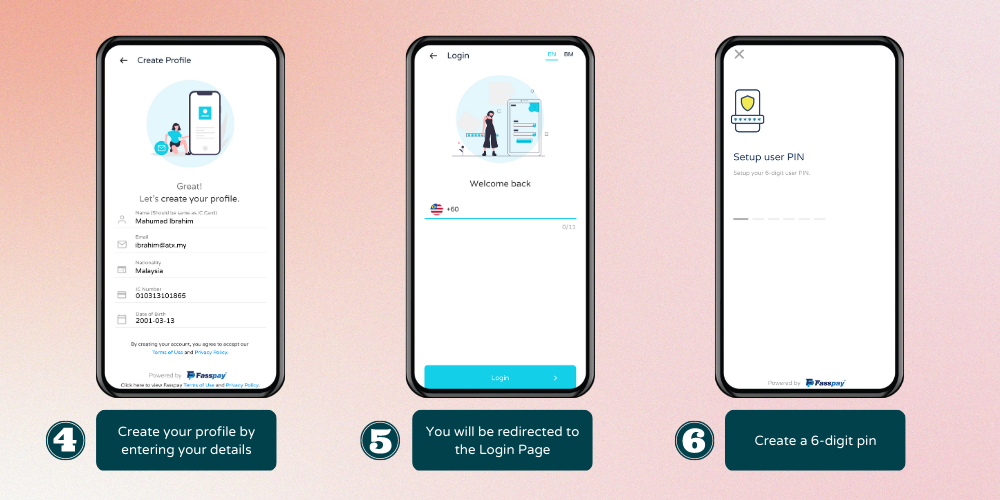

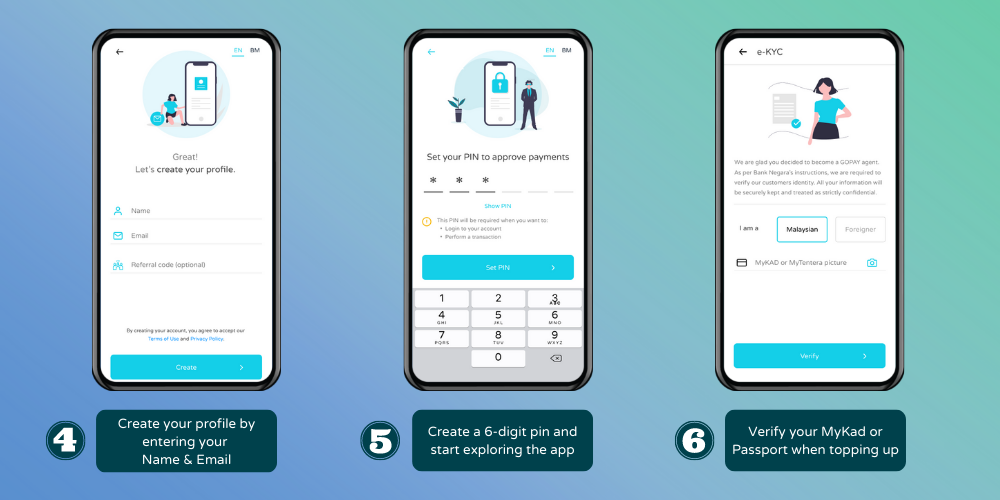

Steps to verify your e-KYC

- Open your GOPAY app and tap on “Login Now”

- Enter your registered mobile number and tap on “Send Code”

- Enter the 6-digit code you received via SMS

- Enter your name as stated on your IC/Passport, IC number and other personal details

- Tap on “Create” to go to the next step

- Enter your current residential address

- Tap on “Submit” to create your profile

- You will be redirected to the Login Page

- Log in again using your mobile number

- Set up your new PIN for added security

- Re-enter your PIN to confirm

- You will be redirected to the e-KYC verification page

- Take a clear picture of the front of your IC in the frame provided

- Repeat the process for the back of your IC

- Look straight in the frame provided and take a clear selfie

- You have completed the verification process and are redirected to the home page

- Enjoy using all the services on the GOPAY app!

What happens if my verification fails?

If there is an issue with your verification, a pop-up message will appear informing you about the hiccup. You would be redirected to our customer service Whatsapp.

Please inform our customer service agents regarding the issue and they will personally help you with your verification.

What if I am NOT a Malaysia IC holder?

For non-Malaysians, do not fret. If you have a local Malaysian phone number, you can enjoy the GOPAY services too!

Simply register using your passport number and fill in your personal details to start the e-KYC verification process. For verification, simply submit a picture of your passport’s front page instead.

Having an issue with the verification process or got a question for us?

Feel free to get in touch with us via email at [email protected] or via Whatsapp at +60177353268.

*Subject to terms and conditions.

GOPAY – The App That Allows You to PAY and EARN

GOPAY - The App That Allows You to PAY and EARN

As we transition into a cashless society, the movement of digital billing and transactions has swept the nation. However, this comes with the headache of installing multiple apps and visiting multiple websites just to track and pay your bills.

With the GOPAY app, save yourself the hassle by having a one-stop payment app for your bills and transactions.

But that’s not it. You can even earn Cashback from your transactions.

Yes, you read that right! You can earn while you pay!

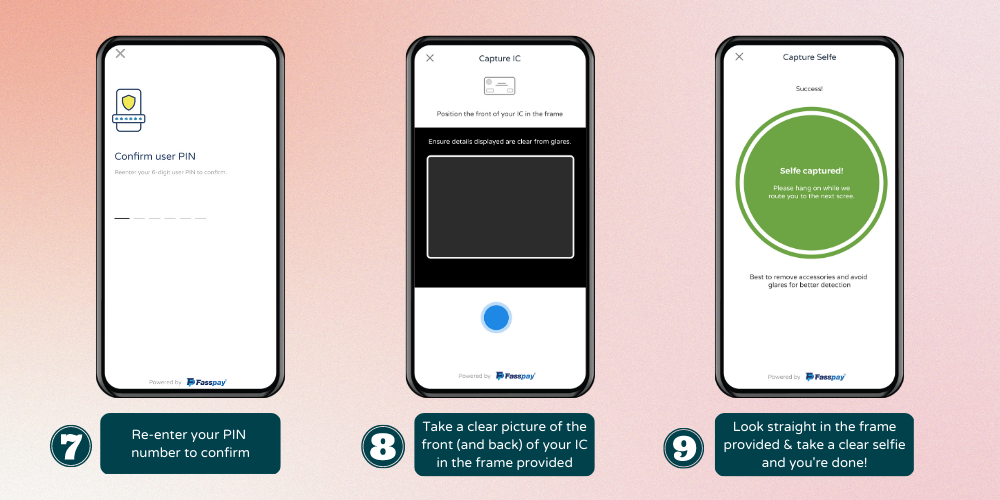

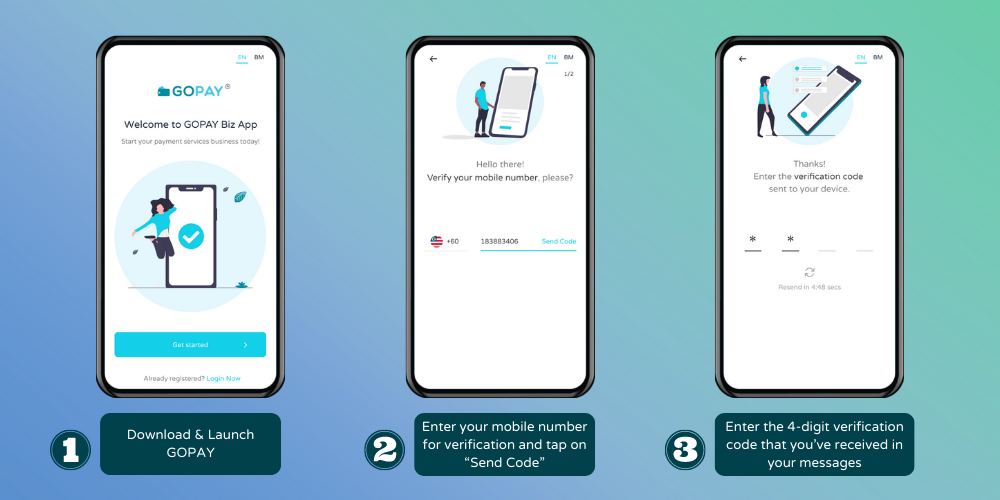

Sign-up within minutes and start earning today

Sign-up within minutes and start earning today

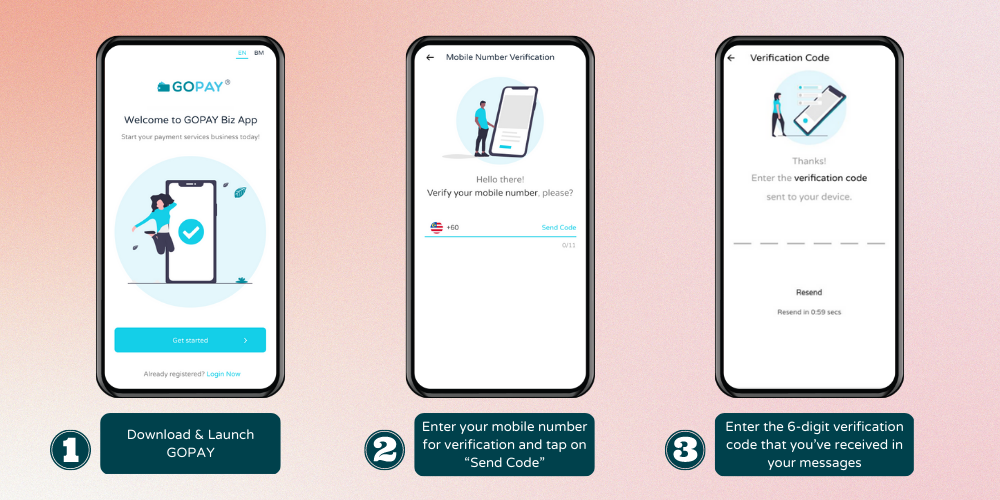

Signing up is easy with our latest interface. Just follow these simple steps:

- Download the GOPAY app from Google Play Store (Coming very soon to iOS)

- Launch the app and tap on “Register Now” at the bottom

- Enter your mobile number for verification and tap on “Send Code”

- Enter the 4-digit verification code that you’ve received in your messages

- Create your profile by entering your Name and Email

- Create a 6-digit pin and start exploring the app

- Verify your MyKad or Passport when topping up

Start enjoying the cashback from your bill payments!

Why choose GOPAY?

We all struggle to keep tabs on our monthly and annual payments. In the digital era, we spend hours on end on various websites and apps, each dedicated to one service. What was intended to make life easier has now overwhelmed us and made such payments overly complicated.

GOPAY provides a solution to that problem. GOPAY offers an all-in-one app to handle your payments.

You may now easily manage your essential utility bills, telco bills, council bills and loan payments while benefiting from our other payment services, which include entertainment subscriptions, gaming points, e-wallet top-ups and lifestyle products.

Our services are expanding every month. Insurance payments, scan & pay services, parcel shipments, gold trading and many more are coming soon to GOPAY.

Skip the long queues, multiple browser tabs and app-flooded home screens by enjoying over 100 payment services on the GOPAY app.

Other benefits of using GOPAY include:

- Cashback

Earn instant cashback while paying your bills. The more transactions you make with GOPAY, the more cashback you will receive!

- Instant E-Receipts

Receive e-receipts instantly after your payments to easily keep track of your payments all in one place. Favourite it for your records or share it with others!

- Auto-Pay

Lack of time to handle your payments throughout your busy schedule? Set up the auto-pay feature for effortless payments.

With over 100,000+ downloads to date, GOPAY is expanding all over Malaysia as an e-transaction service with offers you can’t refuse. Sign up and be part of the GOPAYer movement today.

Having an issue with signing up or got a question for us?

Feel free to get in touch with us via email at [email protected] or via Whatsapp at +60177353268. If you wish to read more about us, click here.